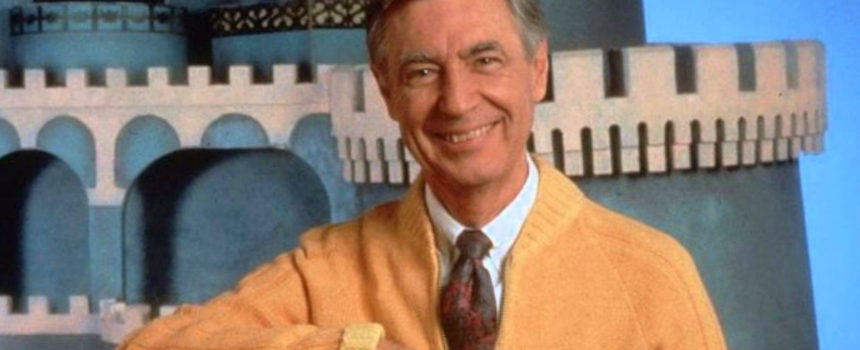

For kids, the Land of Make Believe in Mister Rogers Neighborhood was a wonderful place to go, totally safe from harsh realities of life and filled with magical, whimsical characters like King Friday XIII, Sara Saturday and Prince Tuesday.

But now that we’re all grown up, we know that the Land of Make Believe is certainly no place to do business. Commerce takes place in an all-too-real world, and it depends for its survival on factual, real information. Exaggerated or misleading information entered into CRM can, through faulty business analysis and forecast, lead an enterprise unwittingly back into the Land of Make Believe.

For many companies, CRM is the central storehouse of sales data. Executives and salespeople look to it to find out where sales cycles stand, how the next sales period (month, quarter, year) is shaping up, what needs to be fixed, who needs to be coached and mentored, and what actions need to be better supported.

But CRM data can often be exaggerated and incorrect. Salespeople, responding to heavy pressure or incentives, enter overly optimistic closing dates, projected amounts of sales and other data that’s not quite truthful. This seems little more than a “little white lie” at the time it’s done—but such data can have an enormous impact on a sales organization and on a company. To the degree that CRM data is incorrect, so can forecasting be off and analysis be totally wrong.

An Example from Real Life

A fantastic real-life example of where faulty CRM data can lead was provided by Dave Brock, leading business consultant and president of Partners in EXCELLENCE, in a 2013 blog post recently reposted on Membrain.com.

Several years ago Dave was called into a tech company that claimed to have a pipeline full of opportunities, but a great deal of trouble with salespeople closing them. After questioning the sales executive, Dave finally decided to take a look at the pipeline data himself, as he suspected there was more to the situation than anybody really knew.

It turned out to be the right move. Dave found the first oddity, one that the sales executive apparently hadn’t noticed. “The typical sales cycle for this organization was just a little over 120 days,” Dave wrote. “I saw a huge number of deals that had been in the pipeline for a very long time. Many were around the 250-375 day mark, a few around 500 days, one over 700 days, and one for 1,200 days. I looked at the last time an activity was recorded against these deals—many had no activity for over 50 days.”

After questioning salespeople as to why these deals had been left in the pipeline, Dave concluded that none were actually real and they were eliminated. There went 30% of the “very full pipeline.”

Dave turned his attention to newer deals in the pipeline and made another odd discovery: There were a high number of deals that were projected to close in 30-60 days, despite the fact that the average sales cycle was over 120 days. Dave questioned the salespeople as to why they were making these projections. “It turned out many of the deals were real,” Dave reported. “They had rock solid strategies; the only problem was the salesperson was being unrealistic with the expected close dates. So I asked them about it. ‘Well we’re under a lot of pressure to bring things in, so I put a much earlier date–I’ll do everything I can to make it happen, but I’m really not confident.’ It was a fair response–management was creating pressure that caused salespeople to put unrealistic dates into the pipeline–and they slipped, and slipped.”

After the “dead deals” had been scrubbed, sales projections corrected and a few other, more minor, issues dealt with, the pipeline looked radically different. Instead of 7 times the coverage needed to make sales targets, the pipeline was reduced to a somewhat dangerously low 3 times. “Already, we could see a huge shortfall in the next 2 quarters,” Dave said.

With an accurate, realistic pipeline now mapped out, Dave was able to isolate the actual problem—and it wasn’t closing, as the sales executive had asserted. The real issue was with prospecting for high-quality leads. Once that was solved, the company was back on the road to high sales and prosperity.

Paving a Road to the Land of Make Believe

Dave’s example illustrates how incorrect pipeline data can lead to equally inaccurate conclusions. In the case of Dave’s client, if he had taken their initial report at face value (that the problem was with salespeople closing), and he had “fixed” that problem, the real issue never would have come to light. Although there would likely have been an improvement in sales, there would not have been a reversion. Further down the road the company would still have been tearing their hair out, wondering why improved closing ratios didn’t fully improve their sales.

Many companies don’t think to bring in an expert like Dave, who knows how to drill down to the cause of a sales problem, and many more may not even be aware that there is a problem. But the bottom line is that the accuracy of your pipeline data has a direct relationship to your ability to properly monitor, control, and forecast your sales. If you don’t know how accurate your pipeline data is, you may be living in the Land of Make Believe without even realizing it.

Tech Won’t Solve the Problem!

Some think—and some CRM companies even assert—that a CRM application alone will make for accurate CRM data. It’s certainly true that some CRM solutions make it easier to view accurate data, but any CRM solution can be “fooled” if salespeople enter inaccurate data. So CRM may be part of the solution, but a larger part of the solution is actually the human factor.

Back to Reality

In Mister Rogers Neighborhood, one simply boarded the Neighborhood Trolley to return from the Land of Make Believe. But when inaccurate pipeline data has landed you there, that return trip takes a bit more work. If you know you have a problem with your pipeline data, or even if you suspect it, you need to take several broad steps.

Analysis and Adjustment of Pipeline Data

Average Closing Time

You need to begin by looking back in time, and determining how long deals have normally taken to close. Nail down an average closing time, then compare that average with the projected closing times for your deals now.

You should make adjustments to any deals with obvious, over-optimistic closing date projections. You should also move any deals that have seriously aged and that have little chance of actually closing out of the pipeline so that they’re not confusing the real picture.

Closing Ratios

If you’ve never done so, you should compute closing ratios (leads to closes) for each of your sales reps. Once that is done, you can also compute the average closing ratio for your team. Individual ratios can be applied to each rep’s quota to see how real it is. The average closing ratio for the whole team can be applied to the overall quota.

Sales Pipeline Steps

Thoroughly analyze your sales process steps. Is the full sales process actually being applied in the real world? Are there vital steps missing? Are there vital steps being skipped? Is your sales process accurately reflected in your CRM solution.

If you’ve never really formulated your sales pipeline, our sales pipeline checklist can be very helpful.

Once you have your pipeline stages firmed up, you should then look at individual stages to see where deals are stalling or hanging up. There may be team member weaknesses with getting sales through these stages; it may be that an earlier stage is being skipped making the later stage more difficult. Perhaps there is a missing stage that should come before or after the one where sales are hanging up.

Leads

Once you have fully analyzed and squared away your sales pipeline, you can then examine your situation with regard to leads. Are you getting in enough high-quality leads to support the sales team? Are they wasting their time chasing up leads that will get nowhere? Are leads qualified well enough so that sales can confidently turn them to opportunities?

You can then take immediate action if you find there aren’t actually enough leads in the pipeline for reps to make their quotes.

A problem with leads might also be indicative of a sales-marketing alignment issue. If so, this should be fully sorted out so that these vital units are on the same page and moving forward with a united front.

What else could be affecting your pipeline?

The Human Factor

There is one element in all this, though, that, if not addressed, will mean you never fully make it back from the Land of Make Believe. That is the human factor.

It starts at the top. A major reason (as Dave Brock discovered in our example) that salespeople tend to exaggerate data is pressure from above. There’s certainly nothing wrong with pressure to make sales. But as you demand sales, you should place equal emphasis on data accuracy. You could even go so far as to provide incentives for the most accurate data, and penalties when accuracy is flagrantly or purposely neglected.

One benefit you can promote is that when data is accurate, the whole company—including salespeople—succeeds to a far greater degree. Forecasts are more accurate. Targets are more real. Salespeople also win when they meet actual and real targets because their odds of doing so were predicted precision.

At the sales rep level, make it a campaign to enter accurate data. Get their understanding on why it’s good for them as well as good for the company. Bring the importance of it home to everyone involved.

Get Help If You Can

If you can, it would be well worth your while to hire a proven sales consultant (someone of Dave Brock’s caliber comes to mind) to assist you in fully assessing your situation. Such consultants have helped many companies get their data squared away so they can use it.

The Land of Make Believe was certainly fun for us all as children. But let’s stay away from there when it comes to CRM data. Made sales data integrity a priority—and watch the results in sales target achievement and your bottom line.

Castle illustration: Evan Pratomo